Only 25% of Bank Deposits Insured – NDIC Boss

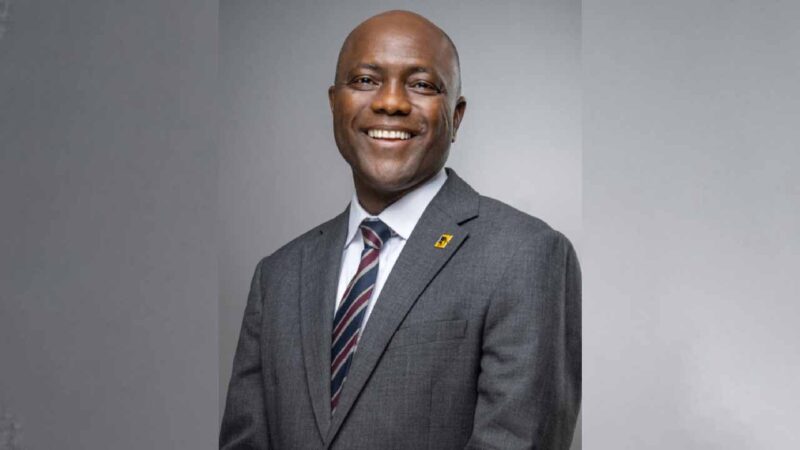

The Managing Director/Chief Executive Officer of the Nigeria Deposit Insurance Corporation, Bello Hassan, has revealed that only 25 per cent of the value of customers’ deposits are insured by the corporation.

Hassan said this on Monday on the sidelines of the 2024 Sensitisation Seminar for justices of the court of appeal in Lagos, themed ‘Building Strong Depositors Confidence in Banks and Other Financial Institutions through Adjudication’.

Addressing concerns about the recent hike in deposit insurance coverage for banks, Hassan said, “As a deposit insurer, we are supposed to review the deposit insurance coverage from time to time to ensure that it is adequate and credible because we believe that is what would endanger confidence among depositors. What we did was to review the existing coverage upward. We looked at the average deposit, other factors like the impact of inflation, GDP per capita, exchange rate and other factors and we concluded that we need to increase the deposit insurance limits.

“Even though the number of depositors we are covering is about 98 per cent, in terms of value we are only covering 25 per cent, which means about 75 per cent of deposit value is not covered.”

Hassan added that the uncovered deposits would eliminate the risk of moral hazard that may arise.

“We believe that the quantum of deposits not covered will enable them (banks) to exercise market discipline and eliminate the issue of moral hazards.

“The coverage is just 25 per cent of the total value of the deposits. Even when you look at the number of depositors, we are covering is about 98 per cent and that is just with depositors with five million (naira) and below. The value of depositors within the system is highly skewed. Only very few, about 1.02 per cent control about 74 per cent of the value of deposits.

So, I don’t think the issue of moral hazards comes in. It has been adequately addressed by the uncovered deposits which constitute the largest chunk.”

The NDIC boss described the judiciary as a critical stakeholder and called for improved synergy among stakeholders.

“My Lords, permit me to state at this juncture that despite the achievements recorded so far, the corporation will not relent in soliciting more synergy and collaboration with the judiciary.

“It is on this note that we urge the appellate court to consider having practice direction for the Court of Appeal on failed banks matters. This we believe, will provide for quick and effective dispensation of appeal matters relating to recovery of debts owed failed banks, as well as, prosecution of parties at fault that might have contributed to the failure of their banks,” he said.

The Presiding Justice of the Court of Appeal, Lagos Division, Jimi Bada, who represented the President of the Court of Appeal, Justice Monica Dongban-Mensem, expressed the readiness of the judiciary to deal with issues arising from the fresh bank re-capitalisation exercise.

He said, “The judiciary is ready. At present, we have what is called a fast track for banking and commercial matters. So, anytime that they come, they are not treated like ordinary civil matters. We treat them with dispatch because it is very important to our nation.

The Secretary of the National Judicial Insitute, Olumo Abdulazeez, who represented the Administrator, NJI, reiterated the fast-track treatment given to commercial matters by the court.

“There is no room for any delay whatsoever when you see that you have been given one or two opportunities to present your case before the court and you are not, no court would tolerate that again. That is in the past,” he noted.

Earlier this month, the NDIC announced the upward review of maximum deposit insurance coverage for various categories of deposit-taking financial institutions licensed by the Central Bank of Nigeria with immediate effect.

It reviewed upward the maximum deposit insurance coverage for depositors of deposit money banks from N500,000 to N5 million; microfinance banks from N200,000 to N2 million; primary mortgage banks from N500,000 to N2 million; payment service banks from N500,000 to N2 million and subscribers of mobile money operators from N500, 000 to N5 million per subscriber. (The Punch)