CBN Partners NSIA, AFC Others To Seek Alternative Funding For Infrastructure

With the decline in revenues due to federal and state government as a result of reduced receipts from the sale of crude oil, alternative ways of funding infrastructure has become critical to ensure sustained growth of the economy.

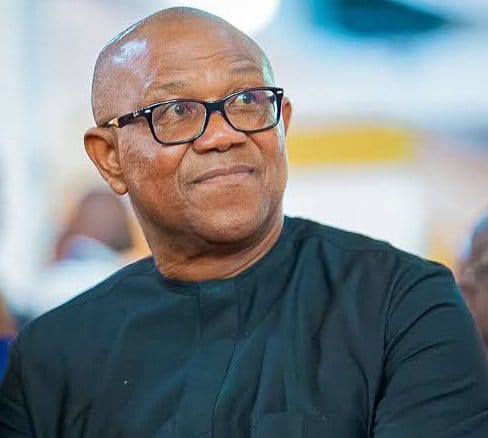

Speaking at the 56th Chartered Institute of Bankers of Nigeria, CIBN, annual dinner on Friday, Central Bank of Nigeria, CBN, Governor, Godwin Emefiele disclosed that to tackle the nation’s s infrastructure gap, the Apex bank is partnering critical stakeholders such as the Nigerian Sovereign Investment Authority (NSIA) and African Finance Corporation (AFC) to set up Infracorp.

He said Infracorp is expected to raise over N15 trillion to support investment in critical infrastructure in Nigeria.

“In recognition of the role improved infrastructure could play in the development of the economy, along with the need to leverage private sector capital in funding the over N35 trillion deficit, which is the estimated amount required to build an efficient infrastructure ecosystem in Nigeria, the Central Bank of Nigeria (CBN) working in partnership with critical stakeholders such as the Nigerian Sovereign Investment Authority (NSIA) and African Finance Corporation (AFC) set up Infracorp. Infracorp is expected to raise over N15 trillion to support investment in critical infrastructure in Nigeria.”

Emefiele said so far, N1 trillion has been provided as seed funds by the promoters to support the operations of Infracorp.

Emefielesaid recently four fund managers has been appointed and a Management Team has been selected to run and manage Infracorp.

He said, ” Over the next two months, Infracorp will kick off its operations by targeting strategic infrastructure projects that would help catalyze further growth of our economy. Infracorp is expected to set the standard template that will help in enabling greater private sector funding for public infrastructure projects in Nigeria.

” A key challenge to supporting growth in key sectors of our economy is access to large pools of cheap investment capital. Today over $100 trillion is held by institutional investors in OECD countries, most of it invested in low yielding assets relative to high yielding opportunities in Nigeria”, he said.

According to Emefiele, Working to tap into this pool of funds will require the set-up of an investment framework that offers comfort and security to investors seeking to invest in critical sectors of our economy, he said.

He said the CBN is working to set up an International Financial Center at the Eko Atlantic City in Lagos, that would serve as a hub for attracting domestic and external capital which is needed to strengthen our post COVID-19 economy.