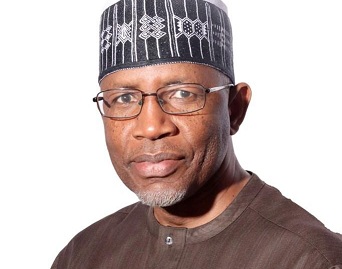

Capital Market Diversification Will Catalyze Nigeria’s Growth Says DG SEC, Yuguda

The Director General of the Securities and Exchange Commission (SEC) Nigeria, Mr. Lamido Yuguda, has reiterated the commission’s commitment to deepening and diversifying the capital market to create wealth for investors and stimulate the nation’s economic growth.

Yuguda, who made the remark at the weekend, explained that development of capital markets would serve as engine of savings, investments and allocation of resources to the projects that have the highest potential for returns.

According to him, effective development of equities markets will create more jobs in the economy, boost revenue for the government and make life easier for all investors.

He clarified that as part of its efforts to develop the market and encourage issues to express their feelings about the delisting of stocks in the capital market, the SEC organized a forum to interface with issuers in a bid to discourage delisting.

The investment expert explained that “when issuers delist, they do because of certain issues. So, we decided to engage Nigeria Employers Consultative Association (NECA) and set up the securities Issuers Forum to discuss the issues and find solutions to them.

In addition, the Director-General disclosed that the commission was working to consider the various issues and ensure that the problem of delisting by companies is brought under check and had also introduced various other incentives to encourage companies to list as listing provides enormous benefits to both the companies and investors.

Yuguda further clarified: “Listing enhances higher investor protection. This collaboration with NECA has been very fruitful and that has given confidence to many of the players. We have started getting interest from the big players.

“We have had some strategic listings like the IPO of MTN, BUA Foods etc and asset class creation or new products like Derivatives have further helped diversify the listings from the huge leaning on the financial sector (Banks and Insurance) several years back.

“The problem with this market is when the big players do not list. So we started getting interest from the big players like MTN. And they decided to come in a very imaginative way. They decided to do the offer electronically so that people having telephones could subscribe without having to go through an intermediary”, he added

While assuring that the Commission will continue to collaborate with market stakeholders to support impactful innovation in the capital market, the investment expert cited the support of the innovation by the Issuing House to the MTN IPO in 2022, Chapel Hill Advisory, which made it possible for over 100,000 new accounts to be electronically opened on the CSCS.